The Inspiring Story of Ronald Read

How a gas station attendant in small-town Vermont quietly amassed a fortune worth $8 million

I wrote the following story for The Investor’s Podcast Network last year. May it inspire you to keep investing in great companies for the long haul, through the market’s ups and downs. Enjoy!

Amassing a fortune

Ronald Read, a gas station attendant in small-town Vermont, quietly amassed a fortune worth $8 million. It’s a powerful lesson in frugality and the powerful effects of compounding.

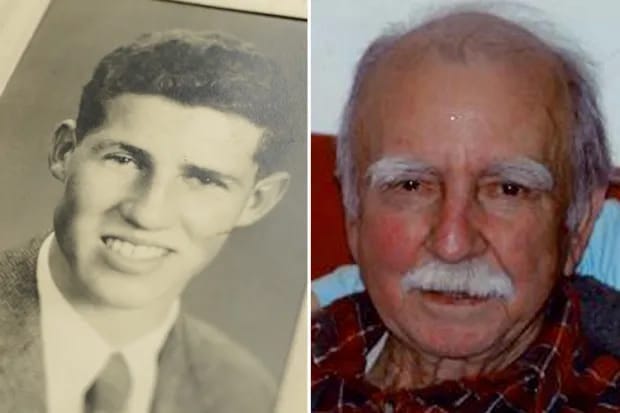

When Read, who lived in Battleboro, Vermont, died in 2014 at age 92, he left about $8 million to charity. He displayed incredible patience and left most of his money to a hospital and library, so his $8 million estate was not subject to federal estate tax. (Part of his library donation allowed the library to extend its hours and renovate its 50-year-old building.)

After working at a gas station, he lived modestly as a maintenance worker and janitor at a JCPenney. Read left a five-inch-thick stack of stock certificates in a safe deposit box. He owned at least 95 stocks that he had held for (mostly) decades.

“Not only did he refuse to flaunt his wealth; his estate included a 2007 Toyota Yaris valued at $5,000, but his closest friends and family members did not know he had even a tiny sliver of the fortune he left behind,” Howard Weiss-Tisman reported in the Brattleboro Reformer.

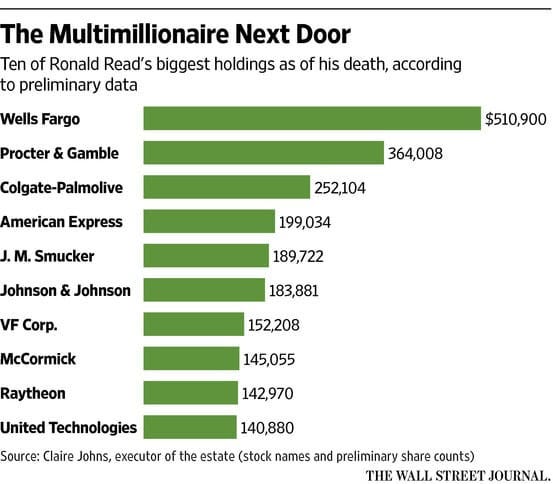

He owned stocks in railroads, utilities, banks, healthcare, and consumer products, avoiding tech companies. He usually bought shares of companies he knew well that paid dividends. He'd usually buy more shares once his dividend checks arrived in the mail. And he had big holdings in Procter and Gamble, J.P. Morgan Chase, General Electric, and Johnson and Johnson.

As reported by CNBC, Read’s attorney said: “He only invested in what he knew and what paid dividends.”

Like any great investor, he made mistakes. His portfolio included shares of Lehman Brothers, which collapsed in 2008. But he diversified so that no one or two failures would fundamentally impact his returns. He read The Wall Street Journal, studied stocks at the local library, and chatted with neighbors about investing.

His family was “tremendously surprised” when they learned of his wealth.

“He was a hard worker, but I don’t think anybody had an idea that he was a multimillionaire,” Read’s stepson Phillip Brown told the Brattleboro Reformer in 2015.

Keeping it simple

Born in 1921, Read was the first in his family to graduate from high school. During World War II, he served in the U.S. military in North Africa, Italy, and the Pacific. Then he came home, married, and had two children. Among his frugal habits, he drove old cars and used safety pins to hold his coat together. A lifelong Vermonter, he cut his own firewood, even in his 90s.

“I’m sure if he earned $50 in a week, he probably invested $40 of it,” said friend and neighbor Mark Richards.

Friends noted that he saved nearly 80% of his income starting sometime in his mid- or late 20s. According to reports, he invested roughly $300 per month at an 8% return for over 65 years.

Lessons for all

There are a few investing lessons here other than patience. Read rarely traded or sold stocks. Because he kept physical certificates, selling shares was a process. He’d need to drive to the bank, then to the office where his brokerage account was. That’s a stark contrast from the one or two clicks it now takes to make a buy or sell on a mobile phone.

He also started investing young and lived long enough to see compounding transform his portfolio. That’s despite the 2008 financial crisis putting a dent in his holdings only a few years before he died.

The Vermont gas station where Ronald Read worked

As the financial advisor Barry Ritholtz said in 2015, “Most investors don’t take advantage of time. They start saving seriously too late in life, they are not at all patient, and they don’t allow the years to work in their favor.”

Given his holdings, it’s worth highlighting that Read wasn’t just a fan of dividends; he capitalized on them by reinvesting dividends, enabling him to keep making regular purchases over time in bull and bear markets.

Would Read have enjoyed greater satisfaction from donating his money while still alive? Perhaps. Could he have enjoyed more of his money with fa? Perhaps. Yet the lasting message of his story lies in how he transformed a modest income into an $8 million fortune. He proves that successful investing is accessible to almost anyone with discipline, patience, and a willingness to learn.